Prod Story 2: What Country?

- John@JPproductservices.com

- Jun 20, 2023

- 6 min read

Once you have your idea defined and developed to a point where you will need help, it is important to consider where your idea will be made as this may affect some details of what is feasible or possibly suggest some improvements that could better tailor the design, its materials, its assembly method, and the testing required as well as the effect all of these have on the final price of the product based on where it will be produced

There are a lot of options currently which increase in the years to come, below I go through the options I see as viable and explain the criteria to be considered when selecting:

China (mainland)

Regardless of the last few difficult years and continuing difficult economic and geopolitical issues China is still THE global superpower of manufacturing development and production for mass consumer goods, it will continue to lose position but has a big head start on upcoming competitors and a labour force developed economies cannot meet at scale. Therefore it is still a safe bet while a diminishing one for large-scale multi-discipline products

Leading Areas: Consumer Electronic Goods, Toys, and anything Smart

Criteria:

Technical Ability China has broad technical and engineering capabilities with longstanding investment in machinery that doesn't exist in developing markets yet

Cost Growing and depending on the area you produce in, Shanghai/Guangdong are expensive, outside these prices can be competitive but technical skill and quality reduces

Lead Times Very dependent on components used and always negotiable

Government Stability Extremely stable but with constantly changing laws and tariffs imposed by the US

Labor Pool Shrinking but OK for now

Manufacturing Base Very broad

Quality and Trust Very variable and requires tight oversight and constant vigilance

Future Changes Difficult to determine as low-cost items become unviable and high-end items are affected by US tariffs

Taiwan

Technically level or better than China in many ways with a cost largely equal also, it is a legitimate alternative to China for some areas but also limited in more diverse multi-discipline products

Leading Areas:

Semiconductor and advanced electronics, computer hardware, telecommunications, and Hybrid Hard/Soft Goods

Criteria:

Technical Ability Very high but specialized, excellent for electronics and textiles

Cost Competitive but probably higher than China

Lead Times Can be shorter as no restrictions and closer access to electronic components

Government Stability Overall stable while small-scale changeable

Labor Pool Skilled, particularly in engineering and high-tech industries

Manufacturing Base Strong, especially in electronics and textiles

Quality and Trust Overall good but vigilance is still required

Future Changes No major changes are expected in the near future

Thailand

For certain industries Thailand does make sense, some electronics, some high-end soft goods

Leading Areas:

Automotive Parts, Appliances, High-End Soft Goods, Hard/Soft Good combinations

Criteria:

Technical Ability Diverse but specialized

Cost High for Asia

Lead Times Highly variable

Government Stability Manageably unstable as changes rarely affect business

Labor Pool Highly variable but with highly skilled specific sectors

Manufacturing Base Well-established across various sectors

Quality and Trust Relatively high but highly variable

Future Changes Expect rapid improvements and innovations and China investment

Vietnam

Vietnam is gaining from China's issues with large-scale investment in factory setup, they are missing technical knowledge or any level of development capabilities but with Chinese companies setting up production facilities it is becoming an attractive location

Leading Areas: Shoes, Garments, Soft Goods, Furniture, Injected Components

Criteria:

Technical Ability Low but improving quickly

Cost Low

Lead Times Generally good but require very close supervision and onsight presence

Government Stability Very stable

Labor Pool Large and young but largely unskilled

Manufacturing Base Expanding rapidly with high investment

Quality and Trust Require constant and close supervision with strict criteria

Future Changes Rapid growth and improvements with their technical level lagging behind the products they produce for some years

Cambodia

Low level but developing with foreign investment and a low-cost labour force, Cambodia will grow quickly in certain areas

Leading Areas:

Garments, Textiles, Soft Goods and Shoes

Criteria:

Technical Ability Low and basic

Cost Low

Lead Times Variable but can negotiate down

Government Stability Stable

Labor Pool Growing but low skilled

Manufacturing Base Expanding with foreign investment but still simple and basic

Quality and Trust Highly variable and requires constant supervision

Future Changes Expect diversification and modernization quickly, but with a lack of highly skilled labour

Laos

Very early stage with low levels, it will grow but is not suitable for many products and will not be for some time

Leading Areas: Garments and Textiles, Wooden Products, and Handicrafts

Criteria:

Technical Ability Very basic

Cost Very low

Lead Times Highly variable

Government Stability Very stable

Labor Pool Small and limited

Manufacturing Base Basic

Quality and Trust Highly variable

Future Changes Large-scale investment is expected especially from China

Malaysia

Large-scale investment by large Electronics manufacturers has greatly developed the supplier base and allows Malaysia to take on more complex products than many other SEA countries but outside the large manufacturers there is a large gap to the local providers limiting wider appeal

Leading Areas:

Electronic Products, Chemicals, Medical Devices, Aerospace Components

Criteria:

Technical Ability Advanced but specialized

Cost High for Asia

Lead Time Short

Government Stability Stable

Labor Pool Skilled and with high English capabilities

Manufacturing Base Strong and diverse but missing connecting and supporting industries

Quality and Trust Good, minimal supervision required

Future Changes Steady improvements while remaining specialized and increased China partnerships

Philippines

With cheap labour but a highly educated population the Philippines has a great potential pool for manufacturing, it has in recent years had more investment and is growing with a highly experienced population that can relocate home to train their younger engineers, the country has a lot of potential and upside though currently it doesn't have the infrastructure needed

Leading Areas:

Automotive, Medical, Garments, and Textiles

Criteria:

Technical Ability Developing but specialized

Cost Low

Lead Time Variable

Government Stability Stable for business

Labor Pool Large and highly skilled and with high English capabilities

Manufacturing Base Growing but specialized

Quality and Trust Good, minimal supervision required

Future Changes Steady improvements and increased international partnerships

Mexico

Given its location next to the US, its low labour costs, and the USMCA agreement, Mexico is a hugely attractive option for producing products for the US, many US and Chinese manufacturers are setting up facilities in the country and it will quickly develop into a major production hub but it is not there yet, nor for the next few years

Leading Areas: Automotive Parts and Vehicles, Aerospace Components, and Appliances, growing as a FATP

Criteria:

Technical Ability Strong and growing base

Cost Competitive with Asia

Lead Times Variable but good due to US proximity

Government Stability For business relatively stable though safety is a question

Labor Pool Large, skilled, and growing

Manufacturing Base Well-established for specific industries and growing for others

Quality and Trust Generally high

Future Changes Expect large-scale foreign investment from both the US and China

Europe

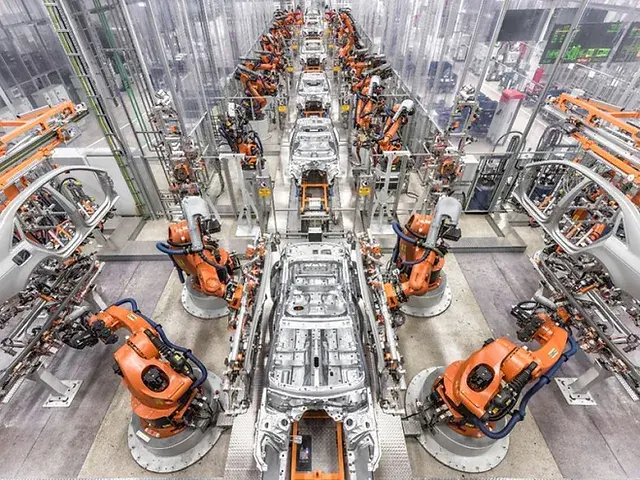

Eastern and Southern Europe still offer decent labour costs while EU access is guaranteed by producing in the region, advanced and complex products will increasingly be located here with more EU legislation making it more cost positive to do so

Leading Areas:

Advanced Manufacturing, Robotics, Luxury Goods, Automotive

Criteria:

Technical Ability Extremely high

Cost High but can be mitigated if split development and production into different countries

Lead Times Good and excellent for proximity to EU markets

Government Stability Very stable with some outliers

Labor Pool Large and skilled

Manufacturing Base Diverse and well-established

Quality and Trust High

Future Changes A focus on innovation and sustainability, reduction in labour involvement, and government incentives to re-shore, expect an increase in insular approaches

USA

Increased internal investment, advancements in automation, and protectionist laws are making the US attractive for producing some advanced and complex multi-discipline products. The high labour costs for more labour-intensive products do limit its appeal for less high-tech products which is not expected to change

Leading Areas: Aerospace, Defence, Automotive, Smart/IoT, and Medical

Criteria:

Technical Ability Excellent

Cost High

Lead Times Good depending on component sourcing

Government Stability Slightly volatile

Labor Pool Large and skilled

Manufacturing Base Large and recovering with investment

Quality and Trust High

Future Changes Expect more protectionist approaches and incentives to produce domestically

Conclusion

For the last 20 years, it has been relatively simple to know where to look to produce your products, China. Now this isn't so clear cut and in the years to come it will become more diversified and depend on the markets you're targeting and the type of product you are making

China will still be a strong contender for global products or anywhere outside the US production but will be harder to produce products for the US and harder to produce cutting-edge technological products, while general multi-discipline consumer goods will still be generally better to produce there

Simpler products or more specific industry products will be splintered off to other countries while the US and EU push for more re-shoring of industries

The next few years will be interesting, short, medium and long-term plans are needed and real thought is needed for the first time in a long time into where the best location is